Talk to us

Have questions? Reach out to us directly.

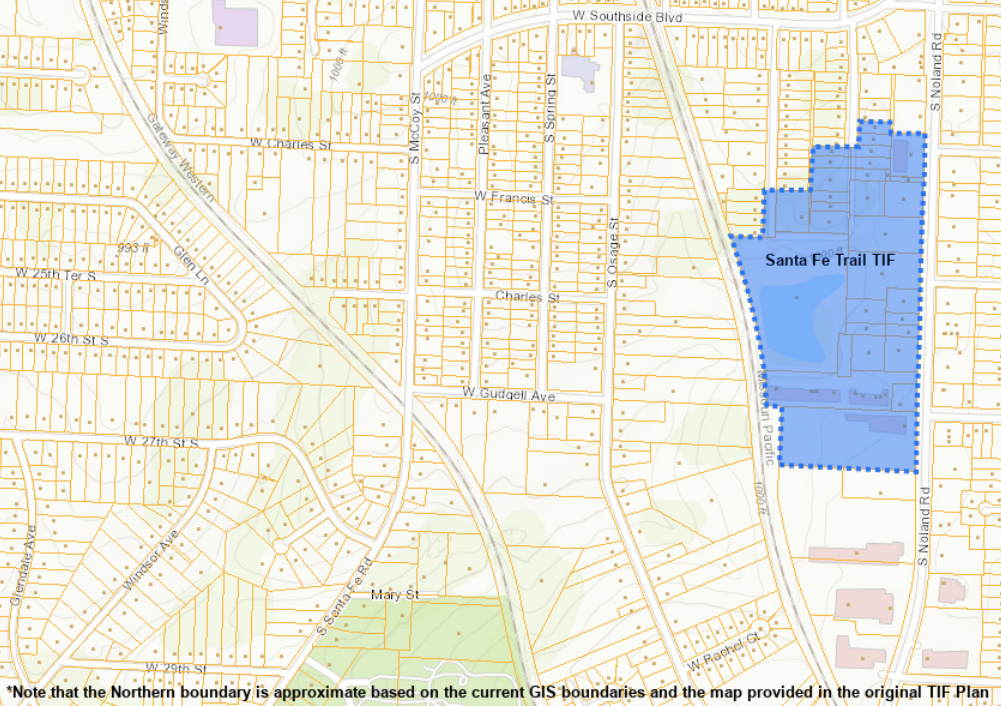

Sante Fe TIF

View allOverview

- Established by the City on December 22, 1997 pursuant to Ordinance No. 130807

- City approved the Santa Fe Redevelopment Project on November 6, 2000 pursuant to Ordinance

No. 14647 - TIF will terminate November 5, 2023

- City approved the Santa Fe Redevelopment Project on November 6, 2000 pursuant to Ordinance

- Project was anticipated to consist of approximately 220,200 square feet of new retail/commercial space, the existing Winstead’s restaurant, approximately eight new residential units and related off-site public improvements generally located on 29 acres along the west side of Noland Road and south of South Side Boulevard

- City entered into a Redevelopment Agreement on August 7, 2000 that has been amended twice

Noland Road TIF Revenues Reimbursement Agreement

- Defines and reimburses the City for shortfall payments, as well as adds revenues to the revenue streams earmarked for the outstanding Santa Fe Bonds

- If the total of

- (a) EATs from the Noland Road TIF Projects 3 and 41,

- (b) Santa Fe TIF Revenues (including PILOTs and EATs, but excluding any payments received by the City

or deposited into the Special Allocation Fund pursuant to the Santa Fe Neighborhood Cooperative

Agreement) - © Interest on the Santa Fe TIF Revenues in the Special Allocation Fund

- (d) Interest on the debt service fund for the outstanding Santa Fe Bonds

- (e) State TIF Revenues from the Santa Fe TIF

is less than the debt service on the Series 2015A & 2015B Bonds,

then the Noland Road TIF Revenues

Reimbursement Agreement requires the City to pay such shortfall from 50% of the 1% general sales tax

within the Noland Road TIF Projects 1, 2, 3, and 4 (“City Super TIF” or “City Additional Contribution”),

and then,

if that does not cover the shortfall, the City will have to appropriate other revenues to cover the debt service (this

last appropriation is what the Developer is require to reimburse semiannually and is referred to as the “City’s

Semiannual Contribution Amount”).

- If the debt service is covered by the TIF Revenues described on (a)-(e) above, the City does not have to add any

additional funds for supersinkers or otherwise, only scheduled debt service must be met - Twice a year the Developer is required to reimburse the City for the City’s Semiannual Contribution Amount, calculated as follows:

- Series 2015A and Series 2015B Debt Service

minus (a) the sum of (a)-(e) above and (b) the City Super

TIF Amount

- Series 2015A and Series 2015B Debt Service

minus (a) the sum of (a)-(e) above and (b) the City Super

- The City does not get reimbursed for the City Super TIF amounts, but does get reimbursed for the City’s Semiannual Contribution Amount (the extent to which the TIF and City Super TIF fall short of the debt service on the Series 2015A and Series 2015B Bonds)

- The Developer has to reimburse the City’s Semiannual Contribution Amount, but only to a certain extent:

- The maximum dollar amount of reimbursement for any semiannual payment date is $116,500 and the

Developer gets a credit against that amount for 50% of any EATs and PILOTs created during the applicable

semiannual period by businesses developed on land in the Santa Fe TIF Area that was vacant on August

19, 2014

- The maximum dollar amount of reimbursement for any semiannual payment date is $116,500 and the

- The City must bill the Developer for the reimbursement on or before June 1 and December 1 of each year with a

calculation of how the City arrived at the amount billed

Revenue Sources

- PILOTs: 100% of the incremental increase in property tax revenues resulting from the annual increase in property valuations over the base property valuation certified at project approval.

- EATs: 50% of the incremental increase in local eligible sales tax revenues (City, County, Zoo) over the base sales

levels in the year before TIF collection was activated ($0). - NEW STATE REVENUES: Subject to annual appropriation by the General Assembly, new state revenues equal

the incremental increase in the general revenue portion of the state sales tax revenues, excluding taxes deposited to the school district trust fund, sales and use taxes on motor vehicles, trailers, boats and outboard motors, and future sales taxes earmarked by law - NOLAND ROAD TIF: Revenues generated from the Noland Road TIF as described in the Noland Road TIF

Reimbursement Agreement

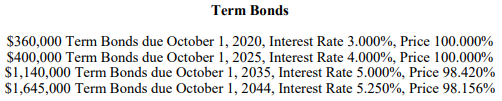

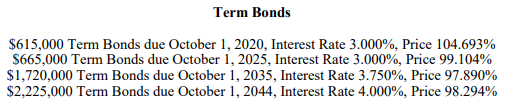

Outstanding Economic Development Bonds for Sante Fe:

Image Gallery

Talk to us

Have questions? Reach out to us directly.