Talk to us

Have questions? Reach out to us directly.

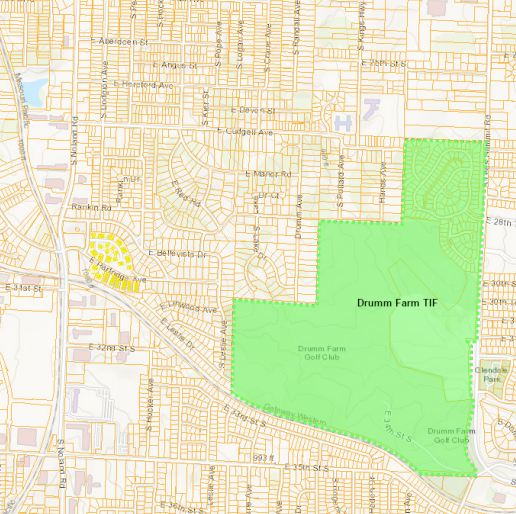

Drumm Farm TIF

View allOverview

- Established by the City on December 6, 1999 pursuant to Ordinance No. 14366

- TIF will terminate December 5, 2022

- Project consisted of an approximately 320-acre tract of land, which was subdivided to provide for the development of 143 residential lots, a public golf course and certain public improvements

- The public improvements portion of the project have been completed and the golf course opened in 2002

- City entered into a Redevelopment Agreement on March 1, 2000 with Golf Strategies, LLC; Redevelopment Agreement has been amended at various times

- Provides that the maximum reimbursement to Developer is $92,974,000

Revenue Sources

- PILOTs: 100% of the incremental increase in property tax revenues resulting from the annual increase in property valuations over the base property valuation certified at project approval.

- EATs: 50% of the incremental increase in local eligible sales tax revenues (City, County, Zoo) over the base sales levels in the year before TIF collection was activated ($0).

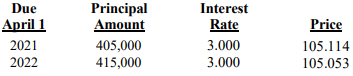

Outstanding Economic Development Bonds for Drumm Farm:

Image Gallery

Talk to us

Have questions? Reach out to us directly.