Talk to us

Have questions? Reach out to us directly.

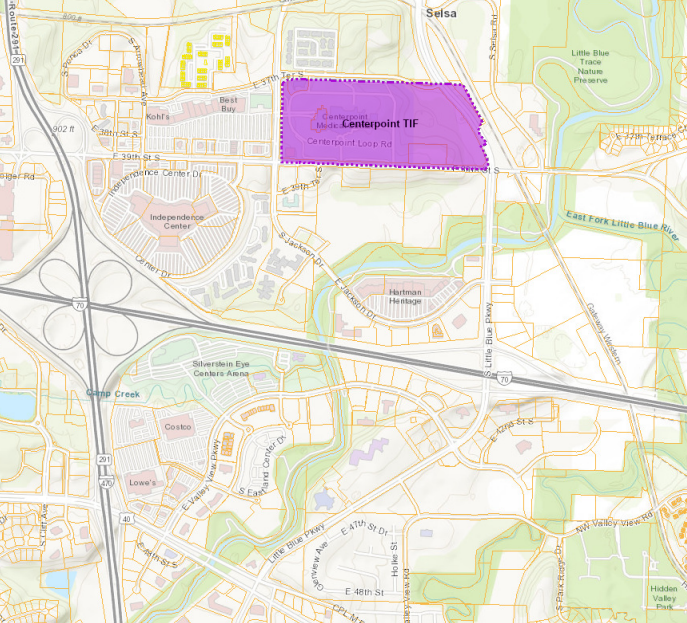

Centerpoint TIF

View allOverview

- Established by the City on December 6, 2004 pursuant to Ordinance No. 15910

- The Developer and City have amended the Centerpoint TIF Plan two times: (1) the First Amendment to the Independence Regional Medical Center TIF Plan approved on February 19, 2008 pursuant to Ordinance No. 16943

and (2) the Second Amendment to the Independence Regional Medical Center (Centerpoint) TIF Plan approved January 19, 2016 pursuant to Ordinance No. 18549 - 3 Project Areas

- Redevelopment Project includes the Centerpoint Medical Center; TIF will terminate on December 5, 2027

- Expanded in 2008 to include the Independence Events Center and corresponding public improvements

- Purpose of this amendment is to pledge PILOTs and EATs in an amount equal to the captured Independence Events Center CID sales tax (1%) revenues and make them available to the City and the Independence Events Center CID to pay project costs and

obligations associated with the Independence Events Center CID

- Purpose of this amendment is to pledge PILOTs and EATs in an amount equal to the captured Independence Events Center CID sales tax (1%) revenues and make them available to the City and the Independence Events Center CID to pay project costs and

- Expanded in 2016 to include the southwest corner of the TIF Area

- Expanded in 2008 to include the Independence Events Center and corresponding public improvements

- Redevelopment Project includes the Centerpoint Medical Center; TIF will terminate on December 5, 2027

- Improvements completed include:

- Centerpoint Medical Center

- Medical office building

- Dialysis Center and Nephrology Building

- Sarah Cannon Cancer Center

- TIF Plan provides for the following:

- Creation of a Building Rehabilitation Fund, which allows for TIF Revenues to be used in the maximum amount of $12,000,000 to provide funding for the redevelopment of the Independence Regional Health

Center ($10,000,000 maximum) and the Medical Center of Independence ($2,000,000 maximum) - Reimbursement of capital costs incurred as a result of the project by the Blue Springs School District in the amount of $2,000,000 and the Independence School District in the amount of $5,500,000

- Reimbursement of City transportation costs associated with providing bus service to the hospital and other locations in the maximum amount of $2,000,000

- Creation of a Building Rehabilitation Fund, which allows for TIF Revenues to be used in the maximum amount of $12,000,000 to provide funding for the redevelopment of the Independence Regional Health

Revenue Sources

- PILOTs: 100% of the incremental increase in property tax revenues resulting from the annual increase in property valuations over the base property valuation certified at project approval.

- EATs: 50% of the incremental increase in local eligible sales tax revenues (City, County, Zoo, Independence Events Center CID, 39th Street TDD) over the base sales levels in the year before TIF collection was activated ($0).

- TIF Plan relies primarily on PILOTs generated as the main source of TIF revenue

Implementation of Building Rehabilitation Fund

- The City, the Independence School District and Edwards Management Group, LLC entered into a Redevelopment Agreement for the Independence Regional Entrepreneurial Center on May 8, 2009 pursuant to Ordinance No. 17288 passed on April 13, 2009

- Provides the arrangement by which TIF Revenues allocated to the Building Rehabilitation Fund would be paid by the City for the redevelopment of certain portions of the Independence Regional Health Center to provide for Independence School District administrative offices and a business incubation center

- As the City appropriates TIF Revenues to the Building Rehabilitation Fund from the TIF Plan, the funds will be paid to the Independence School District in order to allow them to make its own debt service

payments on obligations issued by the Independence School District to fund costs associated with the redevelopment of the Independence Regional Health Center

- As the City appropriates TIF Revenues to the Building Rehabilitation Fund from the TIF Plan, the funds will be paid to the Independence School District in order to allow them to make its own debt service

- The City is not obligated to make up any shortfalls with regards to the Building Rehabilitation Fund from the general fund revenues or any other City revenues; the actual revenues that become available are based entirely on the amount of TIF Revenues produced by the project

Midtown Truman Road Redevelopment Plan

- Payment is calculated annually based on the difference between the revenue generated for all taxing districts by the real property tax levies for all ad valorem real property taxes on the Independence Regional Health Center real property in 2005 and the revenue generated by such real property tax levies on the Independence Regional Health Center real property in the year of calculation

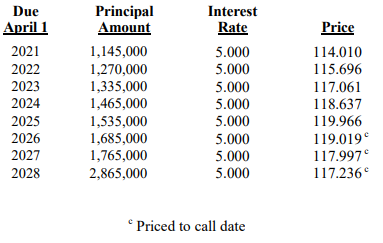

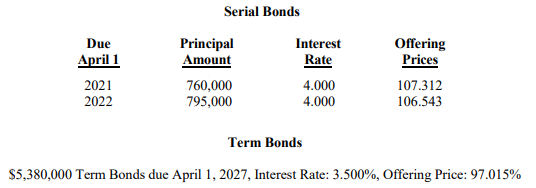

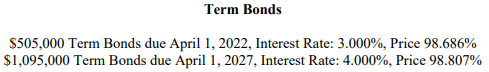

Outstanding Economic Development Bonds for Centerpoint:

Image Gallery

Talk to us

Have questions? Reach out to us directly.